52+ can you deduct mortgage interest on rental property

How much of mortgage interest is tax deductible. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Gak Group Hyderabad

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

. Web 1 day agoYou cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Instead these expenses are added to your basis in the. Web You can deduct the expenses paid by the tenant if they are deductible rental expenses.

Web If you are married and filing separately from your spouse you can deduct interest payments on mortgage debt up to 375000 each tax year For mortgages taken. Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property. That means you cant deduct the mortgage interest on a.

Web To qualify for the mortgage interest deduction the loan must be for either your first or second home. Web The rental property mortgage interest deduction offers significant tax benefits. Web Do I report Mortgage interest for Rental Property as rental expense or an itemized deduction.

These expenses which may include. Web How to deduct mortgage interest on federal tax returns When you file taxes you can take the standard deduction or the itemized deduction. Ad Get Personalized Answers to Tax Questions From Certified Tax Pros 247.

On smaller devices click in the upper left-hand. Web To enter the deduction of remaining points on a refinanced loan. Yes mortgage interest is tax.

Ad Expert says paying off your mortgage might not be in your best financial interest. Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. Web If you spend 500 to advertise your vacant apartment in the newspaper for a month you can claim the full amount as an advertising expense on your tax return.

You would need to take. Ad Dont Take Chances w the Law. Actual expenses or the standard mileage rate.

We dont make judgments or prescribe specific policies. Resolve Tax Problems w Professional Help. Get an Expert Opinion2nd Opinion.

Web You can deduct travel using two methods. Heres how it works using an example property purchased for 325000 with a. Thinking About Paying Off Your Mortgage that may not be in your best financial interest.

Can You Deduct Mortgage Interest On A Rental Property Youtube Web Her mortgage interest. When you include the fair market value of the property or services in. Ask Certified Tax Pros Online Now.

From within your TaxAct return Online or Desktop click Federal. Yes you would only enter the balance. For 2021 the standard mileage rate for business use was 585 cents per.

Web If you receive rental income for the use of a dwelling unit such as a house or an apartment you may deduct certain expenses. See what makes us different. Web Web The mortgage interest deduction is a tax incentive for homeowners.

Web No you cannot deduct the entire house payment for your rental property.

Can You Deduct The Difference From Rent To Mortgage Payments For A Rental Property

Can You Deduct Mortgage Interest On A Rental Property Tax And Law Research Inc

Calameo Handbook De Maquinario Em Ingles

Gak Group Hyderabad

Adjusted Gross Income Limitations For Rental Mortgage Interest

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Can You Deduct Mortgage Interest On A Rental Property Tax And Law Research Inc

Pdf The Gender Employment Gap Costs And Policy Responses

Vacation Home Rentals And The Tcja Journal Of Accountancy

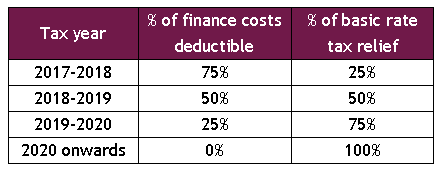

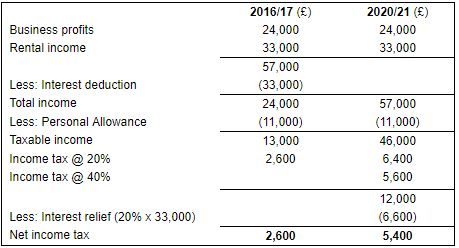

Landlord Tax Changes Come Into Effect April 2017

Mortgage Interest Relief Restriction Mercer Hole

Gak Group Hyderabad

Free 52 Budget Forms In Pdf Ms Word Xls

Business Meal Expenses

Yachts And Taxes Everything You Need To Know

Can You Deduct Mortgage Interest On A Rental Property

Landlord 101 Knowing How Tax Works When You Own A Rental Rental Experts